We are starting to track the home loan market.

Our goal is to bring a practical, unvarnished perspective to who is offering what to borrowers and home buyers. We will do this from both ends; looking at the market share shifts all the way through to the current loan and product offers that potential borrowers can choose from.

What we are about to embark on is a 'pure' mortgage rate comparison service. We won't be ranking offers by how much we can earn from clipping the ticket, nor what institutions will pay to get their offer in front of you. We won't be monetising 'badges' or 'shields' that claim to acknowledge 'the best'.

We will play it dead straight.

We think borrowers deserve analysis that is insightful - for them and the decisions they need to make.

We are new. The reason you will come back and use our service is that you find it useful.

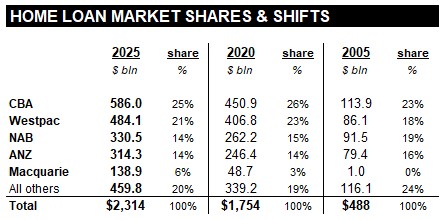

And because we are new we are starting by tracking the big players. Just five big banks, the usual suspects, control 80% of the market. Over time we will broaden our coverage to most of the other 66 banks offering home loans to households and investors. We plan to expand our coverage by five additional banks per month until we have full coverage.

So lets start by describing these big five institutions who offer mortgages.

As at April 2025, the APRA data shows there are mortgages in place worth more than $2.3 tln.

CommBank is the largest with a 25% share and a loan book of $586 bln.

Westpac is No. 2, with a 21% market share in a loan book of $484 bln.

Then its NAB at just over a 14% market share and a $330 bln loan book.

They are followed by ANZ at 13.6% share and a $314 bln loan book.

Number five in this list is far smaller, Macquarie at a 6% share and a $139 bln loan book.

No other institution has a loan book anywhere near $100 bln.

These five dominate the market, but it is a highly competitive market that many others covet.

|

Image:

|

A number of things stand out in this table.

First, the compound annual growth rate for this mortgage market is +8.1% over the twenty years 2005 to 2025. That is way faster than the growth in the overall economy.

Second, CommBank has grown faster than that, +8.5%, aided in part by buying BankWest in 2008.

Third, Westpac has only held its position by buying RAMS in 2007 and St George in 2008. But since, it has shed market share somewhat.

NAB has done its own acquisitions - Challenger in 2007 and Citicorp in 2022 - but they have tended to be tiddlers.

ANZ struggled by leaking market share - until it bought Suncorp in 2024. And there remain questions as to whether that really enables it to compete better.

Macquarie has grown fast, almost exclusively organically but principally because of making it attractive for brokers to turn business their way.

All other banks have struggled to match CBA or Macquarie even though they too try to be attractive to broker networks. However they have seen some minor market share growth in the past five years.

But this is a market led by CommBank. And CBA's dominant advantage is that they avoid brokers when they can and have the smallest (34%) share of book broker-originated. Their dominant goal is to be attractive to borrowers directly. Without having to pay broker commissions, they are building their competitive attractions for borrowers.

That's the overall landscape. Our next review will look at this market from a rate perspective. How do these banks compare on the interest rate, especially when you take into account the packages and fees? A key question: is CommBank really worth considering? They are winning market share at the deal point. What do borrowers see that gets them to sign up?

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.