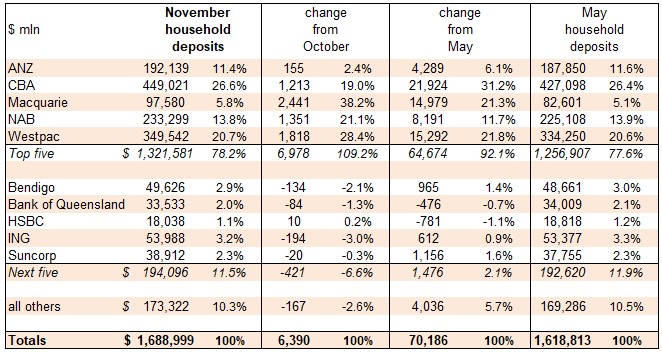

Over the past six months to November, APRA data shows Macquarie winning the battle for household deposits, grabbing share faster even as the overall sector slows.

This out-performance comes even though Macquarie's main rivals have upped their game.

In November alone, and for the first time, Macquarie grew its household deposit book by more in dollar terms than even each of its big four rivals. That added more than +$2.4 bln in the month, taking their six month expansion to almost +$15 bln.

Over the full six months they have left ANZ and NAB in the dust, and are a serious challenge to Westpac now. Only CBA managed a market-share holding gain.

But CBA should not get complacent; all their gains were in the early part of that six months. In October alone it was Macquarie that came out on top.

Winning or holding 'share' is one thing. But losing share is quite something else, and that is the grim position that most challenger banks find themselves in. Bank of Queensland and HSBC actually saw their household deposit balances fall in the six month period May to November. Worse, that extended to almost all challenger banks in the month of November. No main bank had that uncomfortable experience in November, although ANZ should be very worried.

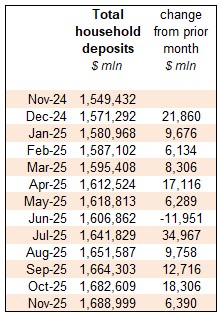

And the worry should be heightened because household deposit balance growth is slowing anyway.

That could be because there are better things to do with bank deposit funds than leave then in a bank. For banks however, they are not only being hit with that trend, Macquarie is making it more painful. Afterall, customer deposits are essential for banks to make loans.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.