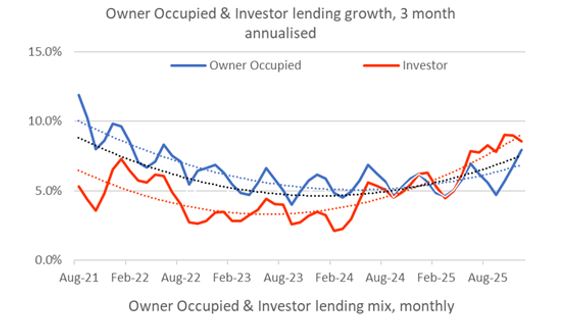

Mortgage debt is rising faster now, and was up +6.6% in December from the same month a year earlier.

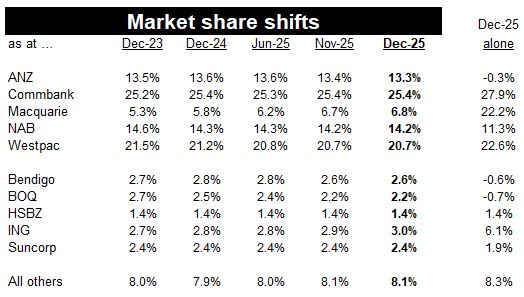

It is at a record $2.43 tln. More than 80% is being loaned by the big five banks.

This Westpac chart gives the relevant perspective.

This is the largest sector of the banking industry, representing more than 60% of all banking sector lending (61.6%), 41.7% to owner-occupied households, 19.9% for residential investment lending.

That enormous size makes it hotly competitive. Somewhat surprisingly, there are substantial market share shifts going on.

As with the household deposit sector, Macquarie is making waves here too, upending the cosy shares on the Big Four. But is isn't only Macbank winning share. others like ING, and even smaller regional banks are making good gains.

Of more interest however is who is losing share. And one major stands out - painfully: ANZ

NAB is also shedding share at an uncomfortable rate.

ING also proves you don't have to be big to win outsized gains.

This data is sourced from APRA.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.