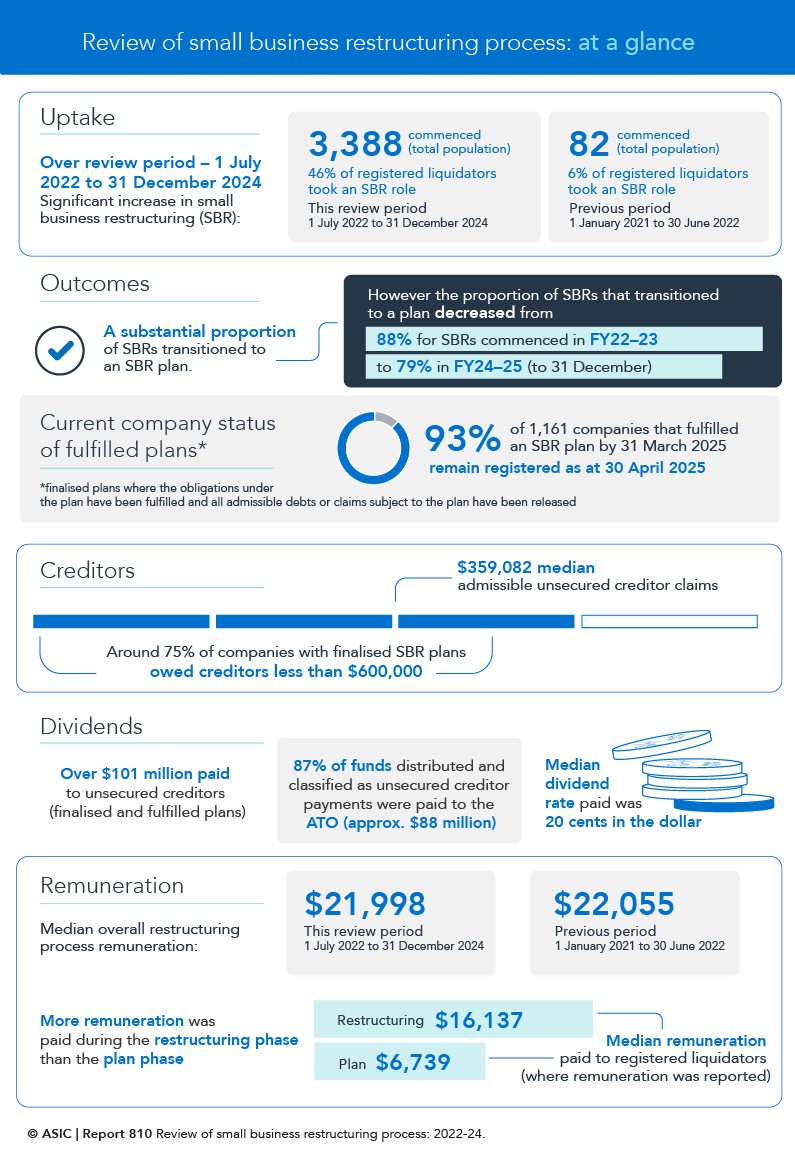

New data from ASIC shows a significant uptake in small business restructurings (SBRs) over the last few years, suggest the SBR regime is playing an important role in assisting struggling small businesses to survive.

In six months to December 2024, there were 3,388 SBR 'appointments' started in the period. There were 448 in the year to June 2023, 1425 in the year to June 2024, and this year it is likely there will be about 3000.

About half of all SBR appointments in this latest six month period came from the Construction sector (27%) and the Accommodation and Food Services sector (23%).

The SBR regime provides a streamlined process for directors of struggling small companies to restructure their debts, while remaining in control of the company.

But the big beneficiary of the process is the ATO. ASIC notes that over $101 million in 'dividends' were distributed to unsecured creditors from fulfilled SBR plans. Almost 90% of those went to the Australian Taxation Office.

The Federal government changed the insolvency framework for small businesses from 1 January 2021. This included creating a new simplified debt restructuring process for eligible small businesses whereby control of the insolvent company is left in the hands of the directors and not the appointed registered liquidator.

As a result, small business restructurings (SBRs) now occur in two phases. First, the appointment of a registered liquidator as the restructuring practitioner, where directors of a company appoint a restructuring practitioner if the company meets the eligibility criteria, and the directors resolve that the company is insolvent or likely to be insolvent and that a restructuring practitioner should be appointed, and a restructuring proposal period of 20 business days commences where the company proposes a restructuring plan.

Then, if one is approved, entering into a restructuring plan.

You can read the full report here.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.