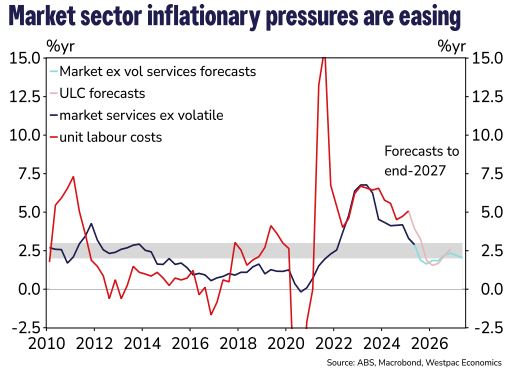

Inflation seems to be easing, although there are still pockets of pressure. However the trend is lower and disinflation is setting in faster than some expected.

The RBA's target is to keep annual consumer price inflation between 2% and 3% and it sets its policy to try and keep inflation at the midpoint of this target. This is the range they have agreed with the Australian Government.

The June quarterly CPI surprised to the downside, coming in at 2.1% and the June monthly inflation indicator came in at 1.9%.

The pressure from services inflation is falling faster than many analysts were anticipating.

Both the central bank and the independent economists watching this key measure look through these headline levels, for the underlying drivers. They do this by focusing on the "trimmed mean" and exclude volatile items. That identifies the core inflation pressures on the economy and informs the RBA's rate setting considerations.

The drop in the headline inflation rate to the bottom of the policy targets, even falling below, isn't actually what is central to those assessments.

The headline rate has been affected by the one-off expiry of various cost of living countermeasures, especially the ending of the electricity subsidies. Without those unique events, what has been surprising has how the levels have fallen despite that. Most elements that make up the CPI have come in pretty much as expected, but there was surprising softness in holiday travel costs, for example.

Analysts are expecting a burst up for electricity prices on the subsidy-ending, but insurance and other core household costs are showing remarkably stable, even soft, signals.

Rents and housing construction costs (to the extent they hit the CPI basket) are also helping keep the index lower than expected.

All this building disinflation pressure will be allowing the RBA to be more confident of a rate cut.

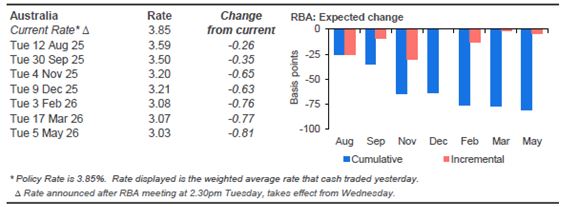

Financial markets have priced in two -25 bps cuts in 2025, one on Tuesday, August 12, and another by Tuesday, November 4. In fact they have half of a -50 bps cut priced in by November. A third cut is priced for early 2026, and that would take rates down to just over 3%.

All that however is very "data dependent", as they say. A wildcard is the US trade bullying and its swirling international impacts. If that only results in lower growth prospects, that will encourage rate cuts, not only in Australia, but everywhere. But tariff-tax inflation elsewhere undermines that. Stagflation can't be dealt with by rate cuts.

But lower than expected core inflation here seems to lock in the August 12 cut. And perhaps open the door for more than -25 bps. We'll know soon enough.

We should not forget however that markets expected a rate cut in July - but the RBA didn't deliver. Buyer beware.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.