If you have funds you need to park for a short time, a bank savings account can be an option to earn some interest in the meantime.

But there is such a wide range of accounts and interest rates on offer, it can be confusing.

Obviously, you should get the 'best deal' you can, but it will take a moment of review to ensure you don't get stuck in an account that offers very low rates, some sub 1%. When rates are that low, there is little point in having a savings account - other than to avoid transaction account fees.

In the right circumstances however, you could earn up to 4.85% pa. Then it makes sense.

In fact, some banks offer rates on savings accounts higher than what they offer on term deposits. Go figure.

We are only analysing the main Big Five banks here because about 80% of customers bank with them. Even if you see a "better deal" at a smaller bank, you should benchmark it against these main bank offers.

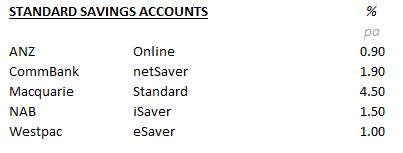

These main banks - ANZ, CommBank, Macquarie, NAB, and Westpac - all have standard savings accounts.

Apart from Macquarie, the interest rate offered on these is modest, averaging 1.30% pa.

But the 'advantage' is that these accounts have few conditions or restrictions. "Easy" however comes at a cost.

If your parked savings are likely to be for a while, and you just might want access to these funds at some unknown time in the future, a conditional savings account may well work well.

These average a per annum return of 4.46%, an advantage of more than +300 bps.

But you will need to understand the conditions. They may require you to add funds (other than interest earned) every month, they most certainly limit your withdrawals to one or none, and some only pay better rates up to a limited amount before the interest rate falls back to a more modest level. So conditional account offers require you to check the T&Cs.

An added advantage of conditional savings accounts is that they help you maintain savings discipline. And if you use term deposits to accumulate savings these conditional savings accounts could be a better option.

'Shopping around' is always good advice when buying anything, and that is true for bank products as much as anything. But bank apps and websites aren't the easiest place to compare. They are all designed to hold you in their happy space environment. That is where comparison services like interest.com.au can help.

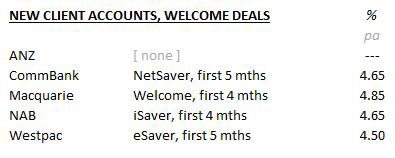

And most banks do offer 'welcome' specials.

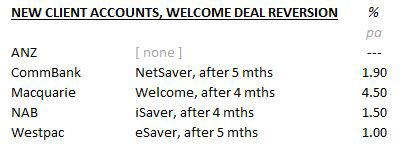

As you can see, these introductory account arrangements are lucrative but only for a short time. On average, that welcome bonus is +20 bps over the conditional accounts. But they are a bit of a honey trap. Most of them revert to low rates when the introductory period ends.

A clear advantage applies to Macquarie customers. Their only limit is that the 4.5% interest rate on their Standard account does not apply to balances over $1 mln. If you hold more than that, the rate drops to 2.25% pa. Still, for anyone with less than $1 mln, a Macquarie Standard savings account will deliver positive after-inflation returns (although maybe not after-tax-after-inflation returns - but then again, no bank savings account will do that).

Before you choose to use a savings account of any type, with any institution, you should be clear why this is the better option for your overall savings and financial goals.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.