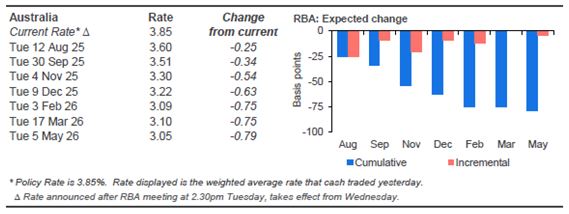

We are only three working days ahead of the next RBA rate review of the cash rate target

Markets have fully priced in a -25 bps cut to 3.60%.

And if that actually happens it will flow through to home loan borrowers quickly. Likely all banks are ready and waiting to announce an equivalent cut on Tuesday, April 12, to variable rates as soon as the RBA confirms the reduction it its rate.

But NAB hasn't waited for that to announce fixed rate cuts, which it released today (August 7, 2025).

The cuts vary by term and LVR, but here is a summary of the main ones for their most common packages.

| NAB | ||||

| Was | change | New | ||

| Owner-occupied | ||||

| Choice P&I | 1 yr | 5.54 | -0.25 | 5.29 |

| 2 yrs | 5.44 | -0.25 | 5.19 | |

| 3 yrs | 5.39 | -0.10 | 5.29 | |

| 4 yrs | 5.79 | -0.10 | 5.69 | |

| 5 yrs | 5.79 | -0.10 | 5.69 | |

| Tailored | 1 yr | 5.54 | -0.25 | 5.29 |

| 70% LVR | 2 yrs | 5.44 | -0.25 | 5.19 |

| 3 yrs | 5.39 | -0.10 | 5.29 | |

| 4 yrs | 5.79 | -0.10 | 5.69 | |

| 5 yrs | 5.79 | -0.10 | 5.69 | |

| Investor | ||||

| Tailored | 1 yr | 5.69 | -0.25 | 5.44 |

| 70% LVR | 2 yrs | 5.59 | -0.25 | 5.34 |

| 3 yrs | 5.59 | -0.10 | 5.49 | |

| 4 yrs | 5.99 | -0.10 | 5.89 | |

| 5 yrs | 5.99 | -0.10 | 5.89 | |

You can compare these changes in detail in our home loan interest rate tables. And in that table you can easily find both the Comparison Rates, and the more useful Effective Rates for your situation, for owner-occupiers, investors, for P&I and interest-only loans.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.