Readers of our home loan interest rate table page can make a savvy decision be comparing rates at nine of the largest mortgage landers, which account for almost 90% of the home loan market.

More than 70% of home loan borrowers are on variable rates. This makes sense when interest rates are moving lower. You get immediate relief from each RBA rate cut.

But what happens when interest rates stop falling? Is being on a variable rate still the best strategy?

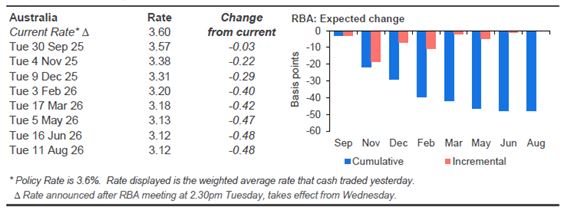

Financial markets are signaling that the next rate cut won't happen until the end of the year, and if there is one more, it may not happen until this time next year.

This financial market pricing is uncertain. It could change. One set of factors that may shift it is a change in economic prospects. For example, if inflation starts to rise, while labour market conditions improve, and economic growth stays resilient and positive, the RBA may need to press harder against inflationary effects. These factors are no longer 'unlikely', rather they are the more likely prospect. If house price stress/inflation keeps rising, it becomes even more likely the RBA will change its tune.

One way to protect your household budget if you have a variable rate mortgage is to convert it to a fixed rate.

In fact, if you do that now, you could save meaningful amounts, even if you stay with your existing bank. You most likely will save more by shifting to another bank on a fixed rate.

Then even if variable rates dip by -25 bps by the end of the year, you will still be paying the bank less for your mortgage if you are on a fixed rate, than if you stay on variable waiting for the rate cut. And it is one that may not even come.

Here is a way to assess what is right for you.

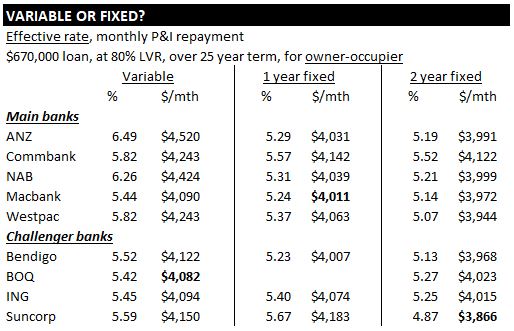

In this case we are looking at owner-occupied P&I loans for a borrower who has an 'average' $670,000 mortgage over a 25 year term. That be not be you, but it will give you a good idea on how to think about what is right for you.

The interest rates in this comparison are the effective rates, not the advertised rates, so that rolls bank fees and package costs into the comparison. What you pay "per month" includes those fees.

Notice that in every case, you save money by switching to a fixed rate. But is it enough to act now and avoid waiting for the presumed RBA rate cut? If we assume the banks will pass it all on (and there is doubt about that), then even if that cut happens, you will still save money at ANZ, NAB and Westpac by switching to a one year fixed rate, and be no worse off al all the others - except perhaps Suncorp. If you switch to a two year fixed, you will be better off at every listed bank, although the amounts might be quite small at Bank of Queensland and ING.

So there are savings, as much as $385/month at ANZ. Switching banks can turbo-charge that. If you are currently at Commbank on a variable package rate, shifting to Bendigo will bring savings of $236 on a one year fixed rate, $276 on a two year fixed rate. And that is per month!

Not to be sneezed at.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.