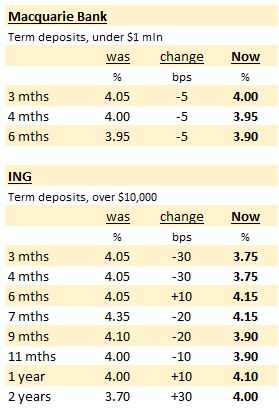

Two banks are the latest to change term deposit rates, Macquarie and ING.

The changes from Macbank are minor and their first in two weeks.

They trimmed -5 bps from their 3, 4 and 6 month term deposits. But even after that, they remain quite competitive in those terms and will think they are well-positioned.

But the more significant moves come from large challenger bank, ING.

Even though they rank among the largest challenger banks, ING only has a 3.3% market share of household deposits. That compares with Macquarie's 5.2% and is well dwarfed by the big four pillar banks at 72.6%. (Commbank alone has 26.5% of all household deposits.)

But ING and Macbank are influential despite their relative small size because their offers help set customer perceptions. However to have that influence they need to out-bid the big pillar banks for term deposits, and they do.

Macbank's 6 month TD offer of 3.90% is far better than CBA's 3.00% (or 3.05% for deposits of $50,000 or more). Macbank only required at least $5,000.

ING was always higher that Macbank, and today raised that premium further for a 6 month TD. Now they offer 4.15%. (However we should also note that they have just ended their seven month 4.35% 'special'.)

The other move ING has made today is to steepen their rate curve. Now their two year term deposit rate is 4.00%, up +30 bps from the prior 3.90%.

At the one year TD term point, ING now offers a +60 bps premium over Commbank, at 4.10%.

You can find all current term deposit rates here and here where they are updated as soon as banks make their changes.

(Note that both Macquarie and ING has marginally lower investment grade credit ratings that the big four. You can compare credit ratings here.)

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.