Challenger bank ING has front-footed the RBA with two good fixed home loan rate reductions.

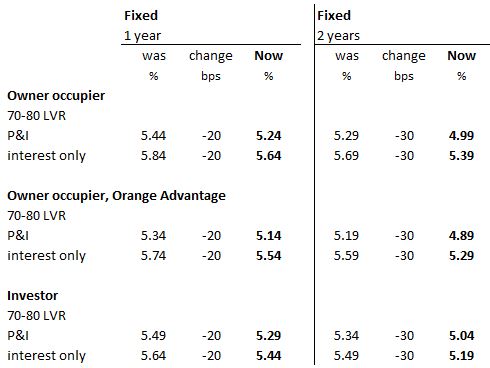

They have cut two year fixed rates by -30 bps, and have cut one year fixed rates by -20 bps.

With the Orange Advantage package, that takes the advertised rate down to 4.89% fixed for two years for a P&I mortgage. That is only bested by Suncorp's Home Package Plus.

On the official comparison rate basis, it is the market low. But there are issues using Comparison Rates, principally because they assume a $150,000 loan amount.

For a more realistic $670,000 loan amount, over 25 years at an LVR less than 80%, the ING rate shines still but not quite as mich as the Suncorp rate.

Readers can check advertised, comparison, or effective rates using the tools on our rate table here. This enables you to set the comparisons that match your situation.

But here is a simple 'advertised rate' summary to start your review.

The key observation is that the new ING fixed rate offers are lower than most offers by any of the big four banks. However, a lot depends on LVR settings, interest-only or P&I, and the fixed term or variable. You can get all this current data from our rate table page.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.