There have been a couple of interesting tweaks from two major banks on the home loan front to start the week.

First, Commbank has withdrawn its "Green Loan" offer for new clients.

This is their 3.99% loan for both owner-occupiers and investors to fund an energy efficiency upgrade.

But while they no longer take these loans under the "Green Loan" category, you can still get it for this purpose as a 'Personal Loan" and currently at the same rate. However be aware, this is a variable rate, and while the "Green Loan" borrowers may retain that through runout and repayment, there is no guarantee that will also apply to the "Personal Loan" for these home energy projects.

A much more interesting change is from Westpac.

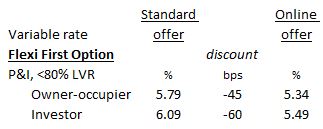

The Red Bank has ended its "Online Refinance" offer and replaced it with a new "Flexi First Option" online offer.

This offers lower rates than the old "Online Refinance" option, and significantly lower rates that their standard "Flexi First Option".

So why would they do that?

Well, Westpac is just making a move like their other rivals to generate mortgage business through their online processes so they have a direct relationship with the borrower - avoiding a broker.

Broker fees can cost a bank about 80 bps in commission. Online processes are very much more 'efficient' for the bank. And to encourage adoption, Westpac is making it price-attractive to have clients join it by this direct channel.

Westpac is only doing this under competitive pressure. Dominant Commbank is the master of direct mortgage origination and it is a large part of their profit advantage. Westpac would like some of that. And it is prepared to make it attractive for you to take notice.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.