Commbank is now offering some more inducements to savers who take up some term deposits.

For a deposit of at least $5000, they have added 0.25% to their six month rate, taking the interest rate to 3.25%.

This offer applies to any such TD to $50,000. Above that the 0.25% bonus takes it to 3.30% for any deposit to $2 mln.

Compared to their main rivals (in alpha order), ANZ offers 2.95 to the same term, Macquarie offers 3.65%, NAB offers 3.00%, and Westpac also offers 3.00% if it is online, but 2.90% if applied for in a branch.

Challenger bank comparisons are generally higher, but not all. You can find all rate comparisons here.

Commbank also offers 3.80% for an online 12 month term deposit. This is easily the best of the main banks, even Macbank, and up there with the very few challenger banks with 'high' offers.

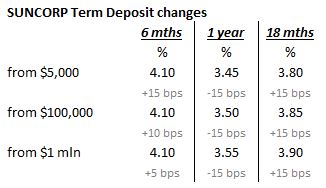

Meanwhile, Suncorp has joined the party with higher term deposit offers. Their updated changes released today are a bit fiddly, and best reviewed in table-form.

Meanwhile, Suncorp has taken -10 bps off all its unique Flexi Rates offers for 3 months to 1 year. That sets them lower than their new term deposit rates, but leaves them with the flexi advantages.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.