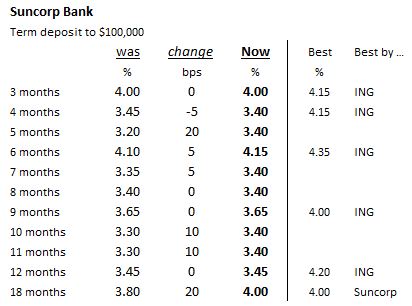

ANZ-owned Suncorp Bank has raised many term deposit rates, moving closer to some key challenger banks.

The changes however also included at small dip for their four month rate.

But their big move was by adding +20 bps to their 18 month rate, taking it to 4.00% and making it a market leader for that term.

Their +5 bps add-on for six months makes this 4.15% a 'good' rate, far better than any major bank who are basically only offering about 3% (or less).

Suncorp's offers are far, far better than parent ANZ's. How long will that last, do you think? But at least if you lock it in now it can't be taken away if there is an 'alignment' The new ANZ CEO isn't afraid of 'moving-fast-and-braking-things'. He is certainly on a change mission.

At the same time, Suncorp Bank has tweaked its fixed home loan rates for both owner-occupiers and investors. It has shifted its one year rates up by +40 bps, its two year fixed rates down by -10 bps, and its five year rates up by +20 bps. Despite these shifts, its still in mortgage limboland, however. An advertised 4.89% rate for two year fixed is good (Home Package Plus). But that is 5.25% on the [irrelevant] Comparison Basis, 4.97% as an effective rate for a $670,000 P&I owner-occupier loan - which is quite good but not market-leading.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.