November is starting with two banks tweaking their variable home loan rate offers.

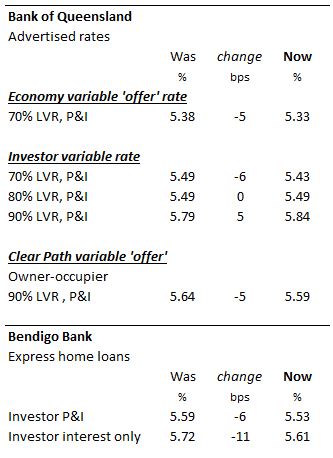

Bank of Queensland has trimmed -5 or -6 bps from some 70% LVR rates. And it has trimmed -5 bps from its high LVR Clear Path variable 'offer'.

These trimmings keep its rates among the lowest among the larger banks. BOQ has variabler rates basically at their fixed rate levels.

But it has also added +5 bps to its high LVR investor variable rate.

Separately, Bendigo Bank has trimmed some rate settings, but only for investors.

Bendigo Bank has variable rates mostly lower than its fixed rate offers, a somewhat unusual situation.

Here is an easier way to see these changes.

For all rates, including an easy way to convert the advertised rates to either Comparison Rate, or Effective Rates, check our comprehensive rate tables here.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.