Challenger banks are making gains in funding from retail savers. And they are doing that with rates of 4% and higher.

This is forcing some of the large 4-Pillar banks to respond. The latest is Commbank who have launched a 4% one year term deposit 'special'.

But this is just the latest move by them to guard against outflows of savings funds to those challengers.

Commbank's new one-year 4% sits alongside their 4.45% variable introductory rate on a NetBank Saver account, their 4.25% potential variable rate on a GoalSaver account, and 4.30% total variable rate on their a Youthsaver account.

Commbank are active in defending their patch, trying to keep their replication customer deposit base stable.

They are a natural target for their rivals, both large and challenger.

Commbank has re-found its competitive groove in this space. It is now recovering market share that it was losing a few years ago.

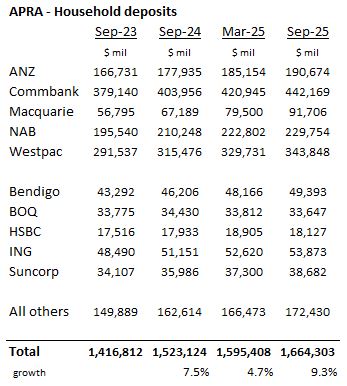

But the big mover is Macquarie, who has a serious appetite for more customer deposits. Apart from Commbank and NAB, they are taking on all the others who are now growing deposit balance less than 'system'.

That competitive impulse is bringing benefits for savers, and 4%-plus rates are the result.

You can check the latest offers from the top-ten banks for savings accounts here. Introductory rates run as high as 4.70% (at ING).

You can check the latest offers from these same top-ten banks for term deposits less that a one year term here. ING has a 4.35% six month rate, for example.

And you can check the latest offers from these banks for term deposits of one year or more, here. ING's 4.20% offer tops this list.

Observant readers will have noticed the inverted nature of these rate offers - shorter terms have higher rates. This is unusual and comes with risks, the main one being that the rate curve will shift back to a normal slope when longer rates are higher than short rates. But that shift could come with savings rates falling faster rather than long rates moving up.

A lot will depend on the current Macquarie pressure. The growth in their household deposits is very impressive, up more than one third in the past year. They have done this by offering outsized returns, hurting the smaller banks and ANZ. If that pressure stops, interest rates offered by the others will normalise quickly. No-one knows when Macquarie will take its foot off the accelerator, but when they do, being locked in to longer term 4%-plus rates will certainly look like a smart move.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.