On rising wholesale rates, bank fixed home loan rates have started moving up, with Macbank leading the way.

(Variable rates have not changed today; they will be waiting for the next RBA decision on the 3.6% cash rate target on December 9, and how money markets react to that decision.)

Others are likely to follow today's Macbank fixed rate moves, based on the cost of money pressures.

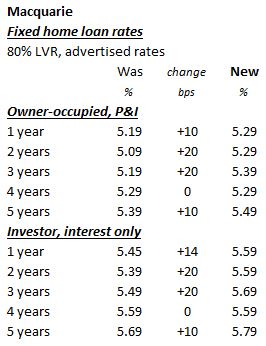

Macquarie has comprehensively raised rates for all fixed terms, except for four years fixed.

That applies to owner-occupier rates, investor rates, P&I rates, interest-only rates, and most (but not all) LVR levels.

You can get the details in our clever rate tables here.

This unique table allows you to see advertised, Comparison Rate, or effective rates for each of the ten largest mortgage lenders (more than 90% of the home loan market), for any type of loan or repayment structure, and any LVR level that applies to you.

Macbank's changes range between +10 bps and +20 bps in this latest hike

Owner-occupier fixed rates compare well with variable rates at 5.34%, and investor variable rates at 5.69% (interest only). So there are still savings to be had by switching to fixed rates even after today's hikes. And it rates do start to rise, lockingt in fixed rates now may have some advantages.

An indication of the money market pressure on funding costs can be seen by how the benchmark one year Australian Government bond yields have moved recently. They are now at an eight-month high (apart from a brief tick up in May 2025.

They are likely to keep rising.

Markets do not expect the RBA to hike its cash rate target on December 9, but they do expect them to warn about upside inflation risks that are building, especially in real estate markets. Money managers have started building their premium requirements in commercial funding rate expectations. And that hits Macquarie harder that the other main banks because Macbank is more reliant on market funding.

Also Macbank has been an aggressive raiser of deposit funds from households, and has been particularly successful at that by offering high at-call rates exceeding 4%. This drive to build more household deposit funding is costly at that level, also pressuring home loan rates. Given the real estate market is rising fast and demand for new loans, especially from investors chasing capital gains, it is unsurprising that Macbank is raising mortgage rates rather than cutting deposit rates.

The pressures on Macbank may be specific, but won't be unique. We understand Westpac will be the next to move, and we will bring you those changes later.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.