Challenger bank ING is stepping up its effort to win new savers.

It has grown its household deposits by +$1.25 bln in the past six month, by +$2.7 bln in the past year. So their recent pace has slowed.

In the face of aggressive moves by rival Macbank, it now has to step up further to defend its fundraising targets.

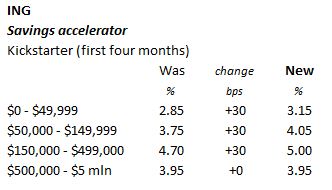

It is doing this with an enhance appeal to savers who are not current clients. The 'welcome rates' for its Savings Accelerator account have been given a good shove along.

ING is now the only top-ten bank offering a 5% rate for any savings account or term deposit.

In fact, this enticement to switch is higher than any Macquarie rate at any deposit level.

The big 4 banks are defending their patch with 4% rates for a term deposit, and ANZ shifted to to that level for an eight month term today, responding to Commbank and NAB who both recently adopted that level for a one year term.

But ING's 5% is unusual.

What happens after four months? At ING it will convert to their 3.95% offer. At Macbank to their 4.25% rate.

But you as the saver could switch it to another institution chasing the highest rate on offer then. ING is counting that you won't, of course.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.