Crikey, she's hard work trying to find the 'best deal' for a new mortgage.

There's so much confusing and muddying of the options, its no wonder borrowers just stick to the main brands.

There's not only the choice between the various 'package rates', there's fees and charges as well. Not to mention rates tiered by LVR.

And there's the not insignificant problem that the requirement by banks to publicise the Comparison Rate just makes things worse. The Comparison Rate is based on all fees and changes rolled into a $150,000 home loan over 25 years. Who borrows like that anymore?

Our clever mortgage rate table page can help with a lot of the comparison. You can isolate rates based on your circumstance - owner-occupier or investor, a P&I (principal and interest) or interest-only loan. We go one further allowing you to specify your loan amount, your desired loan term, and the LVR that applies to you. Then you get a personalised Effective Rate.

Adding to the mountain of options is the choice between a variable rate, or fixed rates.

While that is a good start, then you need to make a choice. We are here to help.

First, understand, we are not trying to sell you anything. We don't benefit in any way from this analysis, no click fee, no advertising, nothing. We are not a broker. We are only an analyst. And this is what we see. Hopefully it is useful.

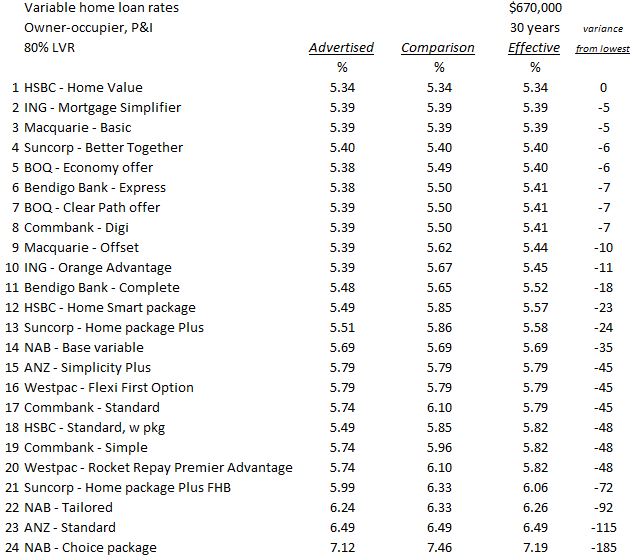

The following rankings are for variable rates. They are based on a $670,000 loan over 30 years, the average level according to the RBA.

For owner-occupiers on a P&I loan, this is how they rank.

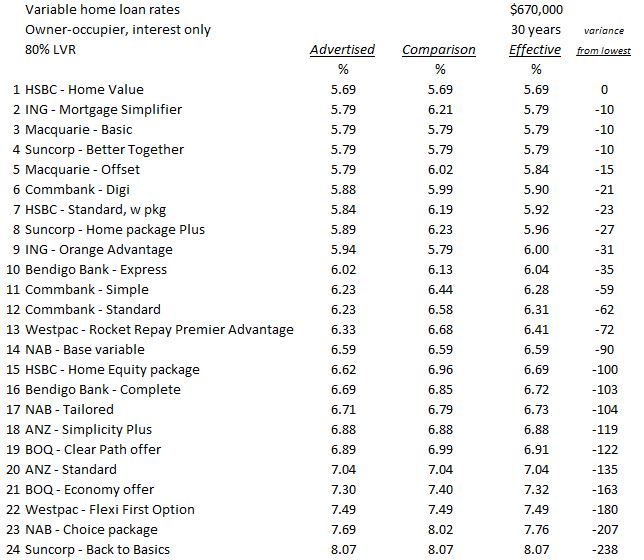

And for owner-occupiers on an interest-only loan, this is how they rank.

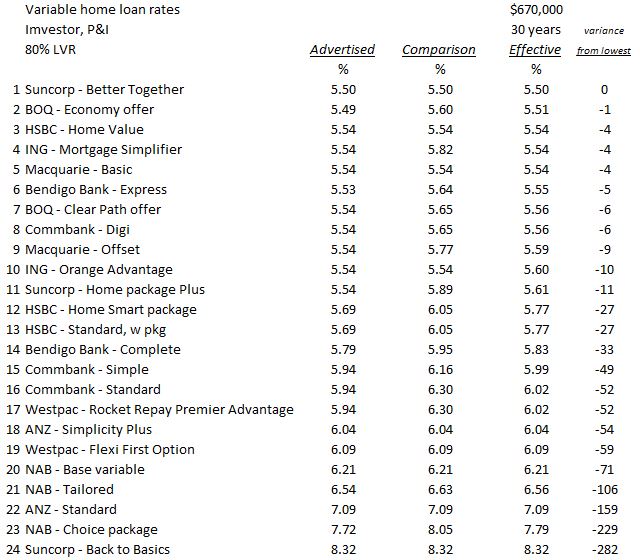

If you are investor, you are dealing with the same issues, but the rates are higher. And some different banks are more (or less) competitive.

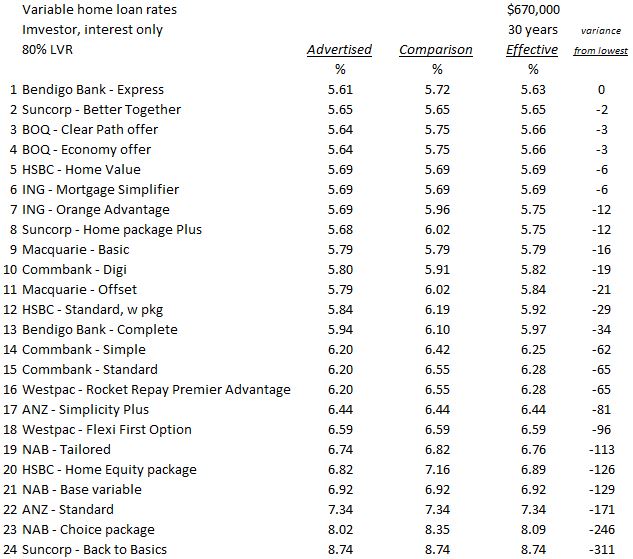

And here is the same comparison on an interest-only basis for investors.

A key thing that stands out in these rankings the the huge difference in cost between the lowest and highest rates in these table, in most cases about 2% and in some more than 3%. Over the lifetime of a loan that can amount to serious cost (or savings), so it behoves you to get the selection right.

The other thing that stands out is that the main challenger banks tend to have the lowest effective rates, the main banks the highest effective rates. So shopping around is important.

Finally, know that front line bank staff have a small window of discretion on non-card rate discounts. Ask. If you use a broker, you are less likely to get a discount because after all, brokers need to be paid (by the bank - yes, brokers work for the bank, no matter what anyone may tell you. If they tell you otherwise, that just emphasises the built-in conflict of interest).

Make a short list of three banks after using our rate table page, approach the banks directly, and ask for a rate discount. What you will be offered, if anything, will largely depend on your financials. It is important to build up your skills in this matter because over the lifetime of your loan you will be faced with rate renewals choices many, many times. Relying on banks or brokers just consigns you to being revenue fodder for them.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.