The household deposit market is big.

APRA data shows Australian households have almost $1.7 tln parked in these accounts.

To a large extent this is lazy money, made up of customer transaction accounts, savings accounts, and term deposits.

Banks use this funding as the basis of their lending activities. It's not their only source of course, but at $1.7 tln it is vitally important.

Over the years the major banks relied on it, almost taking it for granted. It was either 'free money' for them, or paid nominal interest rates. It is inherently short term funding, but banks analyse it closely and have noticed that for a very long time it is stable. Despite being nominally short term, it replicates reliably. That is, depositors don't shift it around much.

But that cozy state of affairs is changing - and bank customers are the beneficiaries.

The trigger for substantial change is Macquarie Bank.

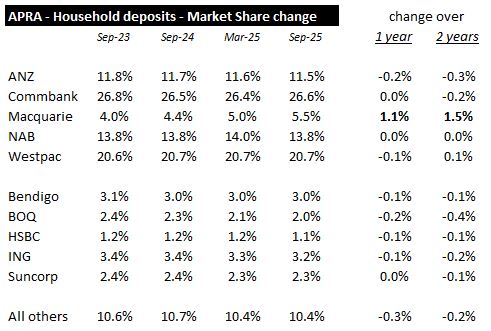

Over the past two years they have increased their deposits from households from $56.8 bln to $91.7 bln, a massive +61% rise. In the past year alone their portfolio of these household deposits rose by more than a third, growing by +$24.5 bln.

Even the largest bank, the CBA, is noticing the attack by Macbank.

And Commbank isn't the bank most affected. All the challenger banks are leaking share to Macquarie. It's easier to note who isn't - only NAB and Westpac.

Macbank have been doing this by offering 4%+ rates for savings accounts. This has really moved their needle.

This pressure is bringing competitive response. The main banks have replied by offering 4% plus rates for term deposits, as we have been reported recently. The pace of competitive response is quickening as it dawns on Macbank's rivals just how much fund-flow is moving.

The AFR is reporting that some banks are starting to worry seriously, including Commbank who of course has the most to lose. They report that to retain substantial deposits, Commbank is offering up to +70 bps above their rate card, others almost double that (135 bps). These offers aren't above Macquarie's rates necessarily, but they are well above what the mainline banks have been offering.

Customers who have more than $500,000 on a bank account are the ones most likely to be able to use that asset to negotiate a better rates. Besides, it has been these customers who have been taken advantage of for a long time, and where Macquaries has spied an opportunity.

Household depositors should grab the opportunity while they can. NEGOTIATE!

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.