Commbank is ramping up its response to the challenges aimed at its market-leading household deposit share.

And it isn't holding back.

As readers will know from a number of our previous reports, Macquarie has been aggressive with its savings account offers, by featuring high interest rates, and higher than for term deposits. That has clearly been attractive for growing numbers of savers because that have been winning large shifts. Macbank has grown these balances by +18% in the past year, according to APRA data, far and away faster than any other bank.

Although they are not a bank that has lost out to Macquarie, clearly Commbank has the most to lose if the challenger comes after them.

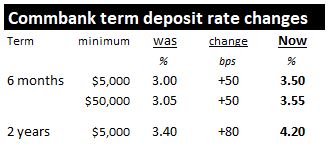

So, today, Commbank has shored up its offers to savers further. This is not the first move by them, but it is the biggest.

And they are doing something that will grab attention.

Macquarie is fighting in the at-call savings space. Commbank is defending in the longer term deposit space.

Macquarie's pitch is high rates for variable-rate products. Commbank's pitch is "lock in high rates" that can't be changed on a whim of a corporate strategy change.

Commbank's new two year rate is market-leading. Although to be fair, at 4.20% pa it is still less than Macquarie's standard savings account 4.25%. Commbank's offer is fixed for the full term. Macbank's is entirely variable.

There are other offers in the market, on various terms. They range up to ING's Savings Maximiser 4.75% rate, or Westpac's unusual Life account's 5.0% for their Spend&Save option on first $30,000. There are some special conditions with this one, of course.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.