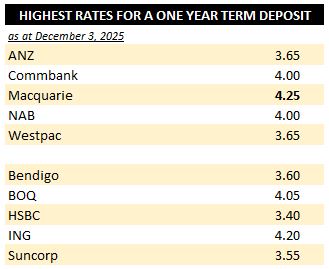

As we reported in November, Commbank and NAB raised their one year term deposit rates to 4% or better, and ANZ and Westpac targeted about 4% rates for shorter terms. They did this to face up to the challenge being mounted with increasing effectiveness by Macbank.

Macquarie has been taking outsized market share in household deposits. Their big rivals are the target, but the challenger banks have been also taking a hit from them. We reported what the October APRA data shows here. Macquaries gains are impressive.

Term deposit rates have been the focus of the defensive moves, because Macbank focused its attack on the at-call savings sector, and while that has been a spectacular success, they were vulnerable to the argument that Macquarie's offer was variable and could change at any time.

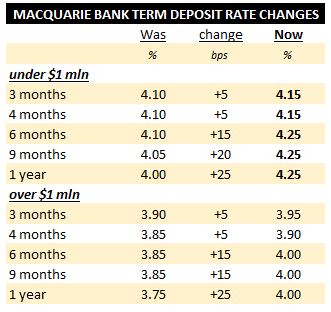

But Macquarie isn't letting their rivals have any comfort at the one year TD position.

They too have upped their one year term deposit offer, now the highest of any of the top ten banks.

And with this change, they have ratcheted up the pressure on those key rivals with a market-leading one year rate.

All term deposit rates for all terms 1 to 5 years are here; for terms 1-11 months here.

Savers are the clear winners here with rising rates. There is $1.68 tln in household deposits, covering transaction accounts, savings accounts, and term deposits. For rival banks it is a honeypot that can be very useful funding for all sorts of lending. And with the economy expanding, and lending for real estate transactions strong (variable rates average about 5.5%), paying over 4% for term deposits will likely come with other benefits, especially if savers also move their transaction accounts too.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.