A new day and the extended procession of banks raising their term deposit rates continues.

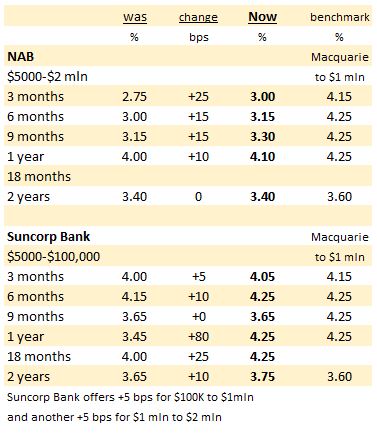

The most recent are moves by NAB, and also Suncorp Bank.

NAB's moves are timid. But they do have an enormous $232 bln household deposit base, and the savings and term deposit portions are all on relatively low rates. So raising their rate card comes with the penalty that it will apply equally to existing customers and raise the cost of their whole deposit book. They hope that even if the raised rate offers don't match the Macquarie challenge, most existing customers will figure it isn't worth shifting. But NAB can only lose market share with this approach. Their calculus is that the margin retained on their embedded deposit base is worth more than the loss of some customer funds. Macquarie's strategy has them over a barrel.

Macquarie has a $95 bln household deposit hase, much less than NAB, but it is growing much faster because of the attractive interest rates offered.

Things are different for Suncorp Bank, a challenger bank with a $39 bln household deposit base. They can't really afford to leak customers to Macbank, and are making sure they don't have a significant disadvantage. In fact, after their recent rate offer rises, there is little difference to the Macquarie rates.

But there is a curiosity involved here. Suncorp Bank is now owned by ANZ. And ANZ's term deposit rate card is like NAB's only lower. ANZ's only fighting term deposit rate is their eight month 4.25% 'special'. It seems pitched at about the most popular term, but alone it looks like a half-hearted effort for any depositor doing a serious comparison across the various terms. Alone, on the ANZ website it may do the job. But on a comparison table like we have, it looks lonely and perfunctory.

You can find our full term deposit tables here and here where all offers from the top ten banks are displayed. These ten account for 90% of all household deposits.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.