Australia's largest home loan lender has today raised its fixed rates.

This change comes as benchmark money costs start to rise.

And some of Commbank's rate changes are substantial.

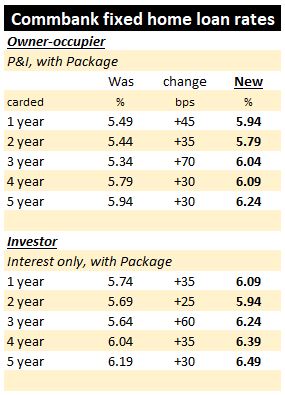

Here is a summary of some key rate changes to its fixed rate offering.

You can get much more detail for both owner-occupier rates, and investor rates in our mortgage rate table. That allows you to inspect advertised rates across a wider range of product offerings and LVR settings, for P&I or interest-only options. You can adjust these advertised rates to see Comparison Rates. Or, the most valuable, adjust to see the effective rate for you based on your loan amount.

Commbank has not changed its variable rates at this time.

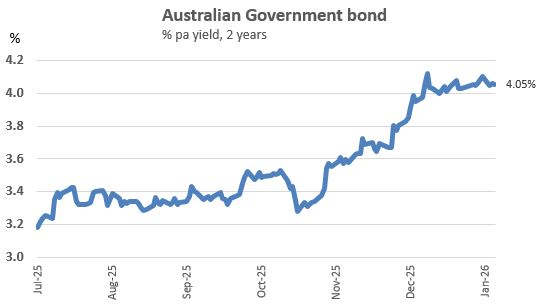

Wholesale money costs are on the move up.

This chart records the 'risk-free' yield for Australian Government bonds, and these started rising from mid-October 2025. More recently, geopolitical risks have risen, and irresponsible fiscal management in the world's largest economy has extended. So risk premiums for non-sovereign borrowers have been rising too, even for investment grade bonds. So the rise in money costs for banks has been steeper than in the above chart.

Commbank's change is the focus of this update, but other banks have been making similar moves today, including Macquarie.

The best way to stay on top of these moves is in our rate table page.

The next RBA rate review is on February 3, 2026. Currently financial markets are not pricing in any change at that time, but in the background more analysts are wondering whether there is in fact a risk of a rate hike then, or a signal that rate hikes are coming in 2026. Those same financial markets have a +25 bps hike fully priced in by August, with rising chances starting in May.

If 2026 is a year of rising rates, it could make sense to lock in a home loan with a fixed rates.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.