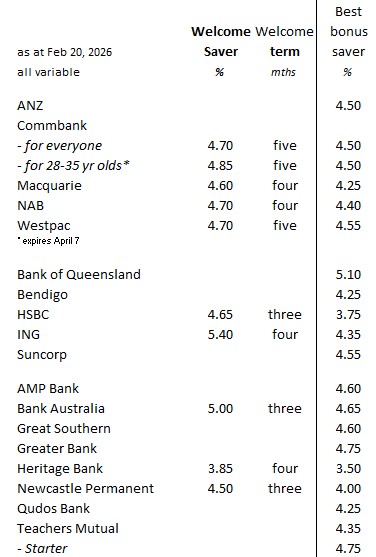

Welcome savings rate enticements are the next big thing to encourage you to switch banks.

The are a bonus off for a limited period after you open a new account. They don't apply to existing customers.

The rates are very attractive.

But they are all 'variable' and can change - up or down - as the bank changes its rate settings. Recently however they have all been going up, although there is no guarantee that will be the case in the future.

And they are all for a quite limited term. After that you are not a new customer, so you will roll off to another standard rate. Of course you can choose what account you want then. If you are there for the at-call nature of these accounts you will want to keep an eye what options you will have after those few months have expired.

And there is little consistency between banks of how long that 'welcome' period lasts.

The largest bank, Commbank, has just raised its welcome rate, and also launched a 'special' for potential clients in the 18-35 age demographic. This newest offer only lasts until April 7, 2026.

Please note there are many more conditions that can be shown in the table above. Please ensure you get all those T&Cs before you commit any funds to any bank. They can be quite different between banks. The table above is only a starting point, although it will help you narrow down what banks you should consider.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.