This week we have had an object lesson on the power of gritty data to move financial market expectations - and pricing.

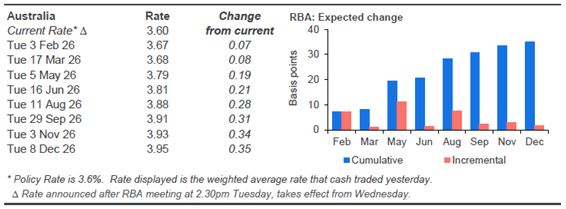

At the start of the week, financial markets were not expecting any change in the RBA's policy rate until mid-year. They had priced in 21 bps for an RBA rate hike of +25 bps at the June 16, 2026 meeting, and had it fully priced for the August 11 meeting. By the end of the year, they only had a second +25 bps hike half priced in.

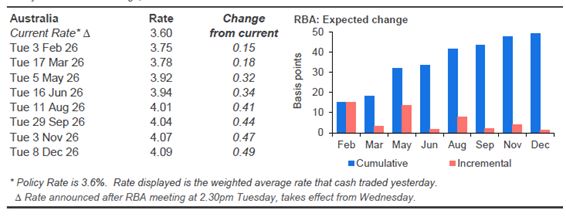

But today, that has changed substantially.

They now see more than half a chance there will be a +25 bps hike on February 3, 2025, they have it fully priced in for May 5, 2026, and a second +25 bps hike priced in by the end of the year.

The reason for the sudden change is yesterday's stronger-than-expected December labour market data.

And these markets are coming to accept that Wednesday's (January 28, 2026) CPI data will stay high, and that the RBA will be concerned about that.

Strong labour market conditions and inflation at the top end of the range demand policy vigilance otherwise inflation will gather momentum and require more painful responses down the track.

Analysts expect the headline December CPI to come it at 3.0%. The more closely-watched "trimmed mean" level for the policy pointy-heads is expected to come in at 3.2%, and the RBA's technical "weighted median" CPI is now expected at 3.4%.

Everything is pointing to higher inflation risk.

If that transpires when the Wednesday data is released, expect a full +25 bps to get priced in for February 3 with a sudden urgency in the public conversation about "interest rates". Markets could well price in three +25 bps hikes in 2026 with a higher-than-expected CPI result next week.

Then 'everyone' will expect the RBA to nip the threat in the bud now before it gets worse. With a strong economy, there certainly is enough resilience to tolerate forceful policy action now to get things back in balance.

A 3.85% cash rate target is looking an odds on favourite.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.