The OECD has just released its June 2025 Economic Outlook.

It says global economic prospects are weakening, with substantial barriers to trade, tighter financial conditions, diminishing confidence and heightened policy uncertainty projected to have adverse impacts on growth.

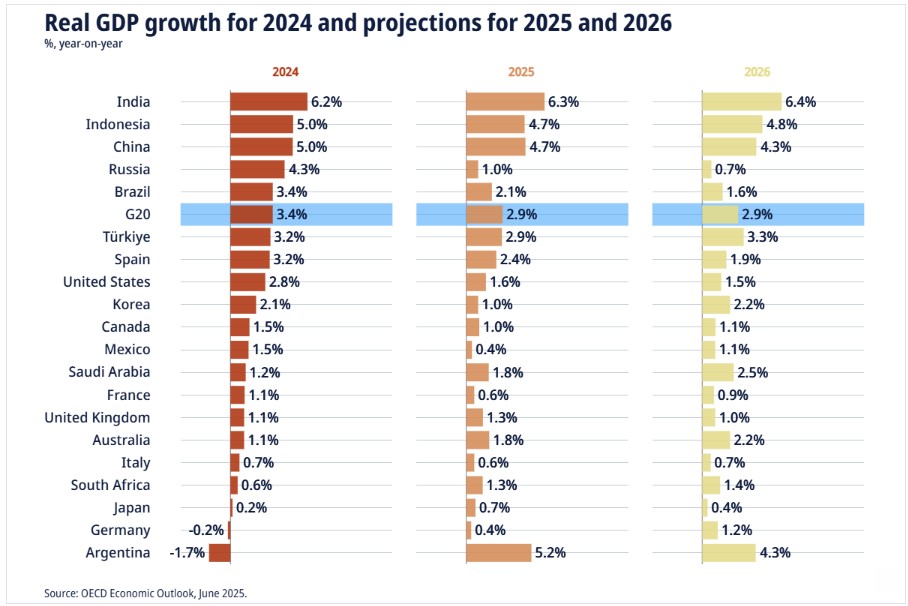

The Outlook projects global growth slowing from 3.3% in 2024 to 2.9% in both 2025 and 2026. The slowdown is expected to be most concentrated in the United States, Canada, Mexico and China, with smaller downward adjustments in other economies.

GDP growth in the United States is projected to decline from 2.8% in 2024 to 1.6% in 2025 and 1.5% in 2026. In the euro area, growth is projected to strengthen modestly from 0.8% in 2024 to 1.0% in 2025 and 1.2% in 2026. China’s growth is projected to moderate from 5.0% in 2024 to 4.7% in 2025 and 4.3% in 2026.

Inflationary pressures have resurfaced in some economies. Higher trade costs in countries raising tariffs are expected to push inflation up further, although the impact will be partially offset by weaker commodity prices. Annual headline inflation in the G20 economies is collectively expected to moderate from 6.2% to 3.6% in 2025 and 3.2% in 2026.

Here is the section on Australia.

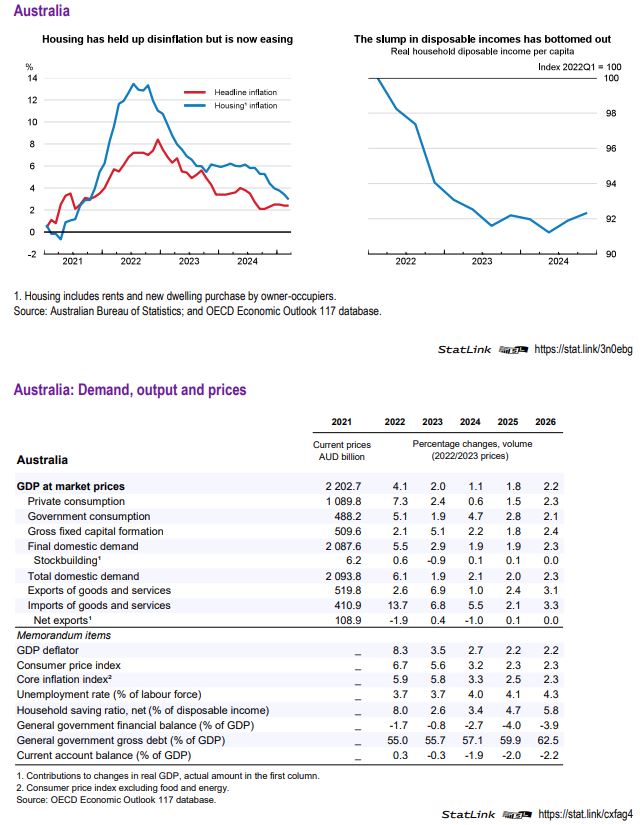

After a period of weak activity, GDP growth will reach 1.8% in 2025 and 2.2% in 2026. The strong recent immigration-driven growth in employment and the labour force will subside, leaving unemployment little changed at low levels. Inflation will remain close to target, averaging 2.3% in both 2025 and 2026. Australia has limited direct exposure to US tariff changes but is at risk from any marked slowdown in China, especially via its effect on commodity prices.

Monetary policy tightening in 2022-24 squeezed disposable incomes and restrained demand, facilitating a return of inflation to target. The easing that began recently should continue in the coming quarters as long as inflation remains subdued. The main fiscal priorities relate to the longer term, addressing demographic and climate challenges and improving the efficiency of the tax system. A range of policy actions, including easing zoning restrictions, is needed to strengthen competition and productivity, as well as to raise housing investment to reverse the long-standing decline in housing affordability.

Public consumption has helped to avoid a hard landing but global trade tensions are hitting sentiment

The growth of private domestic demand – especially consumption and housing investment – was weak in 2024, in part reflecting the cumulative effect of the rise in interest rates since 2022. This weakness was, however, largely offset by strong growth in government consumption. Activity indicators for early 2025, including household spending, suggest that the improved but still moderate private consumption growth seen in late 2024 has continued. Both business and consumer sentiment have worsened recently, however, likely reflecting the elevated uncertainty arising from global trade tensions. The disinflation that began in late 2022 has continued, with headline inflation at or below the mid-point of the target range since September 2024, although the central bank’s preferred measure of core inflation remains above target. Disinflation has been achieved with little deterioration in labour market conditions, with employment continuing to grow strongly – driven by high net immigration over the past three years – and unemployment remaining low. The strength of employment was facilitated by subdued wage growth, while vacancies have fallen back to their pre-pandemic trend path.

Sluggish external demand for Australia’s main export commodities yielded lower export prices and nearstagnant volumes over the past year. The resulting fall in export receipts contrasted with a 5% increase in imports, pushing the current account deficit up to 1.9% of GDP in 2024. Australia’s exposure to US tariff increases is limited given that exports to the United States represent only about 5% of total exports. The impact of global trade tensions on the Australian economy is more likely to come via the depressing effect of higher tariffs and policy uncertainty on investment worldwide, manifested in part by lower prices for iron ore, coal and natural gas.

Monetary easing will continue while fiscal policy is becoming less expansionary

The central bank made an initial 25 basis point cut in the policy rate in February and another in May, and with inflation expected to remain close to target while output growth is below potential and labour market conditions are softening, a further two 25 basis point cuts are expected this year and another in 2026. Federal and state budgets for the 2024-25 and 2025-26 fiscal years imply a widening of the general government deficit by 1.3 percentage points of GDP in calendar year 2025, after an increase of 1.9 percentage points in 2024, before the deficit stabilises at just under 4% of GDP in 2026. This would mean an upward drift in the ratio of public debt to GDP, but net debt to GDP would remain modest, reaching only 6.6% in 2026.

Growth should be close to potential in 2025-26 barring adverse external shocks

Given renewed, if modest, real wage growth and a recovery in real disposable household income as interest rates decline, private consumption growth is expected to pick up this year and next, more than offsetting a slowdown in public consumption growth. Some interest-rate-sensitive investment, such as housing, is expected to rebound in 2025, but other investment will be hindered by elevated global policy uncertainty, leaving overall fixed investment growth little changed from 2024. Final domestic demand growth in 2025 is projected to be around 2%, as in 2024, but with export and import volume growth projected to be similar in 2025, the drag on GDP from net exports seen in 2024 eases, allowing GDP growth to pick up from 1.1% in 2024 to 1.8% in 2025. A further improvement in private consumption and investment in 2026 is projected to push GDP growth up to 2.2% in 2026, roughly in line with potential. The main sources of risk to the projections are external, especially any negative developments relating to import demand in China, by far Australia’s largest export market and the largest consumer of the main Australian export commodities.

Policies should be geared to maintaining macroeconomic balance while addressing structural weaknesses

The expected continued easing of monetary policy is warranted barring shocks pushing inflation back up and/or causing expectations to become de-anchored, but the difficult external context may demand nimbleness on the central bank’s part. The widening of the fiscal deficit in 2024-25 and the further budgeted increase in 2025-26 are justifiable given the weakness of private demand, but governments should look to save any windfalls relative to current plans. Consolidation is needed over the medium term, given the fiscal pressures on the horizon, including population ageing and costs associated with the transition to net zero. Key structural policy priorities are to address the housing affordability crisis by boosting supply and to accelerate progress toward net zero carbon emissions, especially in transport and industry. The revitalisation of competition policy heralded by two agreements between federal and state governments signed in 2024 should also help to reverse the longstanding decline in trend productivity growth, including by boosting business investment via streamlined regulation at all levels of government. This should be complemented by other policies to strengthen investment, including improved incentives for housebuilding, especially for social housing, and public investment to improve electricity grid connections.