The pressure must be on.

Until today, major bank NAB did not have any term deposit offers at the 4% level. It's best previously was a seven month offer at 3.80%.

But key rival Commbank moved late last week with TD rate increases. (They themselves moved up due to challenger bank pressure, especially from Macbank.)

NAB has now changed two key advertised rates. It has raised its 1 year TD rate from 3.70% to 4.00%, whifting its point of attack away from the previously advertised seven month rate which has reverted to 3.10%.

That leaves both ANZ (3.65%) and Westpac (also 3.65%) as the other two main banks with sub-4% one year TD rates.

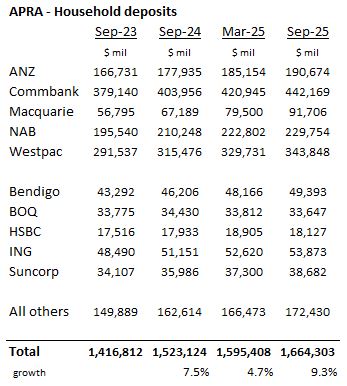

Also, Macquarie's one year rate is only 3.70%. They are aiming their focus on the attractiveness of their at-call savings accounts where they have 4.25% rates, plus a 'welcome' rate of 4.60%. APRA data shows how effective Macquarie has been in attracting household deposit funding recently.

That two major are now offering 4% rates locked in for one year will be attractive to many asvers, especially those who wish to avoid the risk that the current short-term high rates could be trimmed at any time, should a bank like Macquarie decide that is now has generated its needed deposit flows and wishes to pull back. (Nobody know when this might happen, of course. But for savers, it is a risk.)

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.