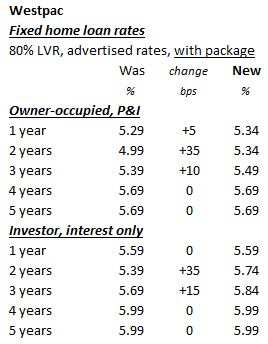

Westpac has raised many of its fixed home loan rates for terms three years and less.

Both are responding to wholesale money interest rate pressures and they won't be the last to raise fixed rates.

Rising fixed rates reduce the cost benefits over variable rates. But that could rebalance when the RBA reviews its cash rate target on December 9, 2025

Westpac's variable owner-occupied P&I rate is 5.79% and the investor interest only rate is 6.59% on the same LVR basis as the above table. So there are cost savings to be had by fixing, and you avoid the risk of an unexpected RBA hike.

Financial markets do not expect a December 9 RBA hike. But wholesale interest rates rose anyway after the stronger-than-expected October labour market data. So you can be sure the RBA will be actively thinking about it. A strong labour market and inflation above target are both signals the RBA won't like. And the RBA has institutional form for pushing through changes market professionals didn't see coming.

You can compare all rates using our integrated rate table/calculator here where you can set the comparisons to match your individual circumstances.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.