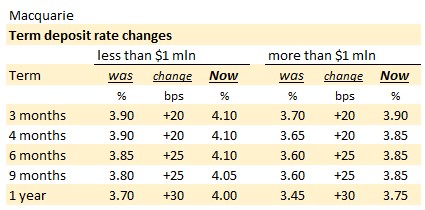

With Commbank and NAB recently raising their one year term deposit offer to 4.0%, and ANZ following with the same rate for 8 months, Macbank has now moved to block those advantages.

Macquarie has been super successful winning household deposits with high savings account offers. That has brought competitive responses from other challenger banks. But it is the shift by some majors to hone in on the one year TD rate that Macbank has felt the need to respond.

And the response is more 'matching' so it doesn't have a disadvantage rather than offering rate premiums.

Macquarie has had to move its TD rates by rather a lot though, just to keep up. Now it has an across-the-board high-rate offer set, it will also be noticing how its cost of funds have risen, It is one thing successfully raising retail funds, the cost of those funds is what the backroom boys at Macquarie will be watching. After all, they offer variable home loan rates at 5.39%. If those 4% deposits are used to fund 5.39% mortgages, then the gross margin is less than 140 bps, which is actually quite skinning for retail banking.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.