As regular readers will know, Macquarie Bank has been making big inroads by winning an outsized share of household deposits over the past two years. Their rivals have responded with various strategies, but Macbank is still going toe-to-toe with allcomers, especially some of the big-four banks.

Last week, for example, it shifted its point of attack from offering high savings interest rates, to pushing up its term deposit rates as well.

Recognition as a significant and systemically important bank came on Friday fro APRA, which named it as the fifth major, saying it is proposed "creating a new tier of Most Significant Financial Institutions (MSFIs) for banks with more than $300 billion in assets. This would currently comprise the four major banks and Macquarie Bank."

But all this aggressive fundraising does create significant cost pressure within the bank.

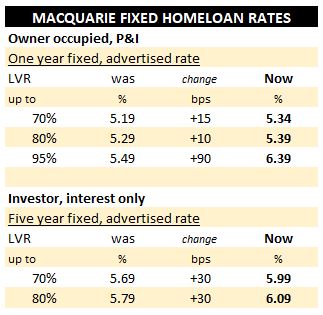

It is responding by raising fixed home loan rates, some quite sharply. Here are some examples of today's moves.

The full suite of moves, on an advertised, Comparison Rate, and Effective Rate bases are in our clever mortgage rate table. You can set this table to customise it for your specific situation, whether you are a owner-occupier, or an investor, whether you want a P&I loan or an interest-only loan. It will even handle your specific LVR situation.

The result is that Macbank no longer has fixed home loan rates that are materially different to their main rivals. They can probably get away with that in a market where mortgage books are swelling at a +6.2% annual pace, up +5.75% for owner occupied loans and up +7.2% for investor loans. There is plenty to go around with these overall mortgage books rising +$140 bln in only one year.

Comments

We welcome your comments below. If you are not already registered, please to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments.

Please to post comments.